Notification of government deficit and debt - 2022 (Second notification, data sent to Eurostat)

Balance of the general government sector for 2022 ended up in deficit

For the year 2022, the balance of the general government sector ended up with a deficit corresponding to 3.2% of the GDP. The general government sector debt in the end of the year 2022 reached 44.2% of the GDP while the year-on-year increase was by 2.2 percentage points (p. p.).

“Compared to the spring notification, the balance of the general government sector improved by 0.4 p. p. mainly as a result of updated information on the corporation tax (corporate income tax) and ended up with a deficit of 3.2% of the GDP. The amount of debt remained almost unchanged and reached 44.2% of the GDP,” Helena Houžvičková, Director of the Government and Financial Accounts Department of the Czech Statistical Office (CZSO), stated.

The balance of the general government sector in 2022 has been revised compared to the notification from April 2023 by CZK 29.6 bn. Not only the central government sector balance improved (+CZK 15.9 bn); the local government sector balance improved, too (+CZK 11.0 bn). The reduction in the deficit was mainly caused by updated data on tax revenues from legal entities.

Table 1: Notification table of government deficit and debt, the Czech Republic, 2019–2022

|

|

Unit |

Year |

|||

|

2019 |

2020 |

2021 |

2022 |

||

|

Net borrowing/lending of general government |

CZK mil. |

16 709 |

-329 216 |

-310 628 |

-217 932 |

|

General government consolidated gross debt |

CZK mil. |

1 740 263 |

2 149 822 |

2 566 731 |

2 997 615 |

|

Net borrowing/lending of general government as % of the GDP |

% |

0.3 |

-5.8 |

-5.1 |

-3.2 |

|

General government consolidated gross debt as % of the GDP |

% |

30.0 |

37.7 |

42.0 |

44.2 |

The total general government sector revenue increased in 2022 by 11.0%, y-o-y; in absolute terms, it was an increase by CZK 277.9 bn. Revenues from social contributions and from income taxes were increasing the most; they were followed by taxes on production and imports.

The total general government sector expenditure increased in 2022 by 6.5%, y-o-y, i.e. by CZK 185.2 bn. Mainly the following increased: social benefits paid, gross capital formation expenditure, and interest paid. A decrease was recorded in subsidies.

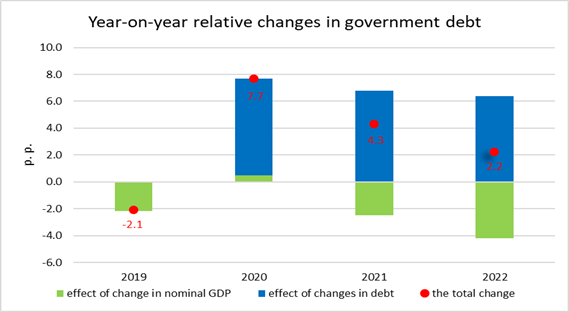

In the end of 2022, the relative debt of the general government reached 44.2% of the GDP. In the year-on-year comparison, the relative indebtedness increased by 2.2 p. p. An increase in the nominal GDP contributed to a decrease of the relative amount of the debt (-4.2 p. p.), whereas the nominal amount of the debt increased in relation to the GDP by 6.4 p. p.

Compared to the spring notification, the amount of the debt has been only slightly revised as for received loans (+CZK 0.5 bn). In the end of 2022, the general government debt reached CZK 2 997.6 bn. Major part of it consists of issued debt securities and received loans.

For the whole year 2022, the debt increase (CZK 430.9 bn) was considerably higher than the general government sector balance (-217.9 bn). The general government borrowed by CZK 213.0 bn more than their need for financing was, which was reflected on the side of assets, mainly by an increase of the value of provided loans, deposits, and other receivables.

Indicators presented in the Table 1 were transmitted to Eurostat on 29 September 2023.

Notes:

Notification of government deficit and debt is compiled always for the past four years and submitted to the European Commission by each Member State of the European Union always at the end of March and September each year, including a projection for the current year. The projection for the current year is compiled and published by the Ministry of Finance of the Czech Republic. Quantification of fiscal indicators is based on the ESA 2010 methodology and serves the assessment of how the Maastricht convergence criteria are complied with. Pursuant to the Maastricht criteria, the government deficit must not exceed 3% of the GDP and the level of the accumulated government debt must not exceed 60% of the GDP.

Government surplus/deficit is represented by the item B.9 “net borrowing (−) or net lending (+)” in the system of national accounts. The indicator refers to the ability of the general government sector in the given year to finance other sectors of the economy (+) or the need of the general government sector to be financed (−) by other sectors.

The government debt consists of consolidated liabilities of the general government sector in the form of currency and deposits, issued debt securities, and received loans. In case of foreign exchange debt instruments hedged against currency risk, value in CZK is obtained by means of a contractual exchange rate.

Responsible head at the CZSO: Helena Houžvičková, Director of the Government and Financial Accounts Department, phone: (+420) 704 688 734, e-mail: helena.houzvickova@czso.cz

Contact person: Jaroslav Kahoun, Head of the Government Accounts Unit, phone: (+420) 274 054 232, e-mail: jaroslav.kahoun@czso.cz

Next News Release will be published on: 23 October 2023

- year 2024 | 2023 (First notification, data notified by Eurostat) | 2023 (First notification, data sent to Eurostat)

- year 2023 | 2022 (Second notification, data notified by Eurostat) | 2022 (Second notification, data sent to Eurostat) | 2022 (First notification, data notified by Eurostat) | 2022 (First notification, data sent to Eurostat)

- year 2022 | 2021 (Second notification, data notified by Eurostat) | 2021 (Second notification, data sent to Eurostat) | 2021 (First notification, data notified by Eurostat) | 2021 (First notification, data sent to Eurostat)

- year 2021 | 2020 (Second notification, data notified by Eurostat) | 2020 (Second notification, data sent to Eurostat) | 2020 (First notification, data notified by Eurostat) | 2020 (First notification, data sent to Eurostat)

- year 2020 | 2019 (Second notification, data notified by Eurostat) | 2019 (Second notification, data sent to Eurostat) | 2019 (First notification, data notified by Eurostat) | 2019 (First notification, data sent to Eurostat)

- year 2019 | 2018 | 2018 | 2018 | 2018

- year 2018 | 2017 | 2017 | 2017 | 2017

- year 2017 | 2016 | 2016 | 2016 | 2016

- year 2016 | 2015 | 2015 | 2015 | 2015

- year 2015 | 2014 | 2014 | 2014 | 2014

Published: 02.10.2023

The data are valid as of the release date of the publication.

Contact: Information Services Unit - Headquarters, tel.: +420 274 056 789, email: infoservis@czso.cz