External trade - 3 quarter

09.11.2010

Code: q-6032-10

External trade 1 in Q1 to Q3 of 2010 (after a year-on-year decrease by almost a fifth in the same period of 2009) reported growth again . External trade turnover increased by 17.4% (CZK 528.7 billion) to CZK 3 571.4 billion compared to Q1 to Q3 of 2009 yet still did not reach the level of Q1 to Q3 of 2008 (CZK 3 723.4 billion). In Q1 to Q3 of 2010 external trade balance finished at the surplus of CZK 98.8 billion, which was lower compared to the same period of 2009 yet, simultaneously, it was the second largest one since Q1 to Q3 of 2005 when the external trade of the Czech Republic recorded an active balance for the first time from establishing of the independent Czech Republic. In real terms, year-on-year exports and imports grew by 18.9% and 19.1%, respectively in January to August 2010

In the period of Q1 to Q3 of 2010 compared to Q1 to Q3 of 2009:

- exports increased by 16.2% (CZK 255.8 bn) and reached CZK 1 835.1 bn; imports increased by 18.7% (CZK 272.9 bn) and attained CZK 1 736.3 bn. Exports and imports grew more strongly in Q3 (19.0% and 24.5%, respectively) compared to Q1 (10.6% and 8.6%, respectively) as well as to Q2 (18.9% and 22.9%, respectively). Q2 and Q3 of 2010 were characteristic by a faster growth of imports to exports by 4.0 percentage point (p.p.) and 5.5 p.p., respectively. The growth of exports (48.4%) and that of imports (51.6%) contributed to the year-on-year (y-o-y) higher turnover of external trade by CZK 528.7 bn. Converted to EUR exports rose by 21.5% and imports by 24.1%; exports and imports in USD increased by 16.6% and 19.0%, respectively;

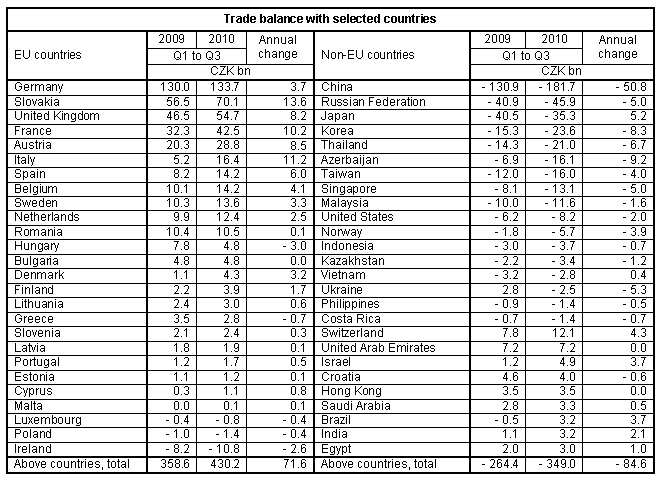

- external trade surplus was lower by CZK 17.1 bn and reached CZK 98.8 bn. The rate of coverage of imports by exports was 105.7% in comparison to 107.9% in Q1 to Q3 of 2009. By group of countries the lower surplus of trade balance was affected only by the year-on-year higher trade deficit with non-EU countries by CZK 88.7 bn, because positive external trade balance with EU countries was higher by CZK 71.6 bn, y-o-y. Trade surplus with EFTA 2 states slightly increased by CZK 0.2 bn and that with the European transition economies remained virtually the same as in Q1 to Q3 of 2009. External trade deficit was lower with other developed market economies (by CZK 7.5 bn). However, external trade deficit increased with developing economies by CZK 25.7 bn, with the CIS 3 countries it rose by CZK 20.2 bn, and with other states 4 grew by CZK 50.1 bn. By commodity section, external trade surplus was reduced in 'machinery and transport equipment' (by CZK 1.9 bn) and increased in 'miscellaneous manufactured articles' and ‘commodities and transactions n.e.c. in SITC’ (by CZK 15.5 bn) and it fell in 'manufactured goods classified chiefly by material' (by CZK 7.9 bn). Insignificant decrease of trade deficit by CZK 0.8 bn was recorded in 'chemicals and related products' and in' agricultural and food crude materials and products' (by CZK 0.6 bn). The negative trade balance deteriorated in 'crude materials, inedible, and mineral fuels' (by CZK 22.6 bn);

- by group of countries, the share of EU countries in total exports dropped (from 84.8% to 84.0%), furthermore, that of developing economies (from 4.2% to 4.1%), and that of European transition economies (from 0.9% to 0.8%); that of EFTA states stayed the same (2.2%). The share increase was obvious in other developed market economies (from 3.7% to 4.1%), in CIS countries (from 3.5% to 3.9%), and in other states (from 0.8% to 1.0%). In total imports, the shares, which decreased, were those of EU countries (from 67.0% to 64.0%) and of other developed market economies (from 6.8% to 6.3%). The shares of EFTA states and European transition economies remained at the level of Q1 to Q3 of 2009 (2.0% and 0.3%, respectively). The shares, which grew, were of other states (from 10.0% to 11.6%), of CIS countries (from 6.7% to 7.7%), and of developing economies (from 6.8% to 7.7%);

- by commodity section of external trade shares in total exports grew of 'machinery and transport equipment' (from 53.3% to 53.6%), 'crude materials, inedible, and mineral fuels' (from 6.3% to 6.8%) and 'chemicals and related products' (from 6.4% to 6.7%). The share of 'manufactured goods classified chiefly by material' (17.9%) remained at the level of Q1 to Q3 of 2009; shares which decreased were those of 'miscellaneous manufactured articles' and ‘commodities and transactions n.e.c. in SITC’ (from 11.8% to 11.1%), and of 'agricultural and food crude materials and products' (from 4.4% to 4.0%). In total imports shares, which increased, were of 'machinery and transport equipment' (from 40.6% to 42.4%), of 'manufactured goods classified chiefly by material' (from 17.9% to 18.2%), and of 'crude materials, inedible, and mineral fuels' (from 11.4% to 12.4%). Roles in total imports were weakened in 'chemicals and related products' (from 11.5% to 10.9%), in 'agricultural and food crude materials and products' (from 6.4% to 5.8%), and in 'miscellaneous manufactured articles' and ‘commodities and transactions n.e.c. in SITC’ (from 12.2% to 10.5%).

Results of external trade in Q1 to Q3 of 2010 were affected especially by:

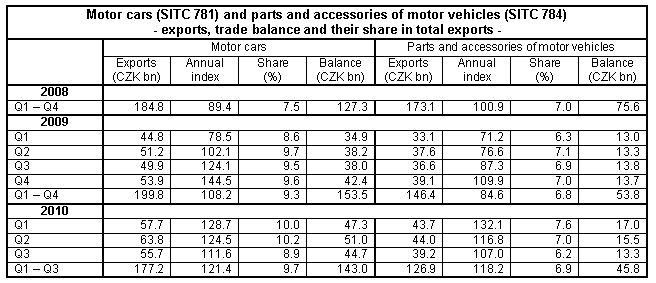

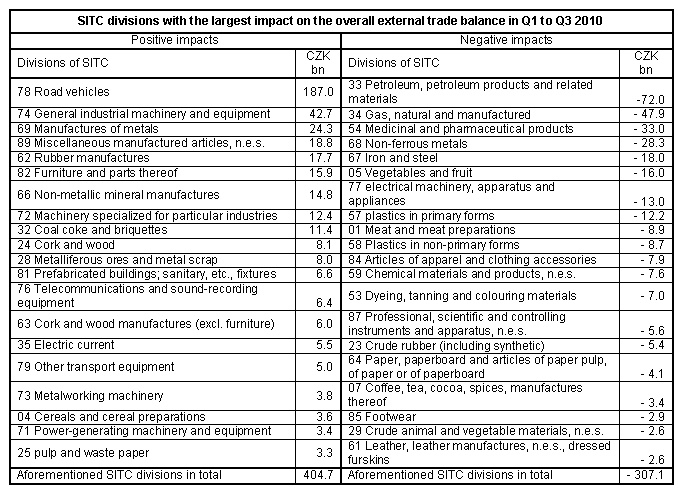

- increasing industrial production in manufacturing industries 5 . The production increase in these industries (thanks to external demand) had a positive impact on manufacturing exports, which increased by 16.7% (CZK 246.3 bn) and their share in total exports increased to 93.6% from 93.1% in Q1 to Q3 of 2009. The most important shares in manufacturing products exports had 'machinery and transport equipment', and out of them especially 'road vehicles', 'electrical machinery, apparatus and appliances', 'office machines and automatic data-processing machines', 'general industrial machinery and equipment', and 'telecommunications equipment n.e.s.'. Exports of 'road vehicles' contributed by 17.4% to total exports in Q1 to Q3 of 2010 (17.1% in Q1 to Q3 of 2009). Trade surplus in ‘road vehicles’ stayed the highest of all SITC classes (CZK 187.0 bn) in Q1 to Q3 of 2010 and was up by CZK 35.4 bn, y-o-y. Surplus in 'motor cars' increased by CZK 31.9 bn and surplus in 'parts and accessories of motor vehicles' rose by CZK 5.7 bn, y-o-y;

The second largest external trade surplus in ‘machinery and transport equipment’ (and simultaneously in total external trade) was recorded for 'general industrial machinery and equipment' (CZK 42.7 bn compared to CZK 30.7 bn in Q1 to Q3 of 2009);

- unfavourable trend in terms of trade 6 . In the period from January to August 2010 export prices went down by 2.2% and import prices increased by 0.5% on average, compared to the same period of 2009. Terms of trade thus reached negative values and therefore had a negative impact on external trade balance at current prices. It can be estimated that export and import prices decreased exports and imports values from January to August 2010 by approx. CZK 39 bn and CZK 11 bn, respectively. Negative impact of prices on trade surplus at current prices for January-August 2010 accounted for about CZK 28 bn;

- the world economy recovery and related improvements in external demand. The economic growth was restored also in the European Union. Gross domestic product of EU27 increased by 2.0%, y-o-y, in the Q2 2010. Recovery of economy in Germany, which is the most important market for Czech companies and therefore to a great extent predestines the development of the total Czech exports, was positive for Czech exports. In Q2 2010 this largest European economy grew by 3.7%, y-o-y. 31.6% of total Czech exports were oriented to the German market in Q1 to Q3 of 2010. Compared to the same period 2009, Czech exports to Germany increased by 11.8% in Q1 to Q3 2010 and their share in the increase of total exports was almost one quarter;

- persisting weaker internal demand (especially consumer one) . That is also indicated by a low increase in imports of 'miscellaneous manufactured articles' (by mere 1.2%, y-o-y, which was the lowest one of all SITC groups), but also of some food products. Imports decreased year-on-year in clothing, footwear and furniture. Investment demand slightly recovered, which caused an increase in imports of a number of machinery items (e.g. 'office machines and automatic data-processing machines', 'electrical machinery, apparatus and appliances’, 'power-generating machinery and equipment', and 'telecommunications equipment n.e.s.'), crude materials, materials and products classified chiefly by material.

A closer look at external trade by group of countries in Q1 to Q3 of 2010 7 shows that year-on-year compared:

- exports to EU countries increased by 15.1% (CZK 201.6 bn) and those to non-EU countries by 22.6% (CZK 54.2 bn). The highest relative annual growth was observed in exports into other states, followed by other developed market economies, CIS countries, developing economies, and EFTA states; exports to European transition economies slightly increased, too. Growing exports to EU countries as a whole reflected higher exports to all EU countries except for Latvia and Greece. The highest absolute increase was observed in exports to Germany (CZK 61.4 bn), followed by exports to Slovakia (CZK 23.0 bn), Poland (CZK 21.1 bn), Italy (CZK 15.9 bn), Austria (CZK 12.9 bn), the United Kingdom (CZK 11.4 bn), France (CZK 11.1 bn), the Netherlands (CZK 9.4 bn), Spain (CZK 8.7 bn), and to Sweden (CZK 6.0 bn). In the group of non-EU countries, exports increased can be given to the Russian Federation (CZK 11.3 bn), the United States (CZK 6.6 bn), China (CZK 5.2 bn), Switzerland (CZK 5.0 bn), Japan (CZK 1.7 bn), and to the Ukraine (CZK 1.6 bn);

- imports rose from EU countries by 13.3% (CZK 130.0 bn) and from non-EU countries by 29.6% (CZK 142.9 bn). The most marked relative increases were recorded for imports from other states, furthermore from CIS countries, developing economies, EFTA states, European transition economies, and other developed market economies. Higher imports from EU countries as a whole resulted from increased imports from all EU countries, except from Latvia and Malta. The highest absolute increases were recorded for imports from Germany (CZK 57.7 bn), followed by imports from Poland (CZK 21.6 bn), Slovakia (CZK 9.4 bn), the Netherlands (CZK 6.9 bn), Hungary (CZK 4.8 bn), Italy (CZK 4.7 bn), Austria (CZK 4.4 bn), Ireland (CZK 3.4 bn), the United Kingdom (CZK 3.2 bn), Spain and Sweden (each CZK 2.7 bn), and Romania (CZK 2.1 bn). Among the non-EU countries, main growing imports were from China (CZK 56.0 bn), the Russian Federation (CZK 16.6 bn), Azerbaijan (CZK 9.4 bn), the United States (CZK 8.6 bn), Korea (CZK 8.1 bn), Thailand (CZK 7.1 bn), the Ukraine (CZK 7.0 bn), Norway (CZK 4.8 bn), Taiwan (CZK 4.6 bn), and Turkey (CZK 3.2 bn). Drops were recorded in imports from Japan (CZK 3.9 bn) and Canada (CZK 0.3 bn);

- external trade surplus fell from CZK 115.9 bn to CZK 98.8 bn. Positive trade balance with EU countries reached CZK 430.2 bn against CZK 358.6 bn in Q1 to Q3 of 2009, and trade deficit with non-EU countries was CZK 331.4 bn compared to CZK 242.7 bn in Q1 to Q3 of 2009. A high trade deficit was still recorded in trade balance with other states (CZK 184.1 bn), and then with CIS countries (CZK 63.1 bn), developing economies (CZK 59.4 bn), and with other developed market economies (CZK 33.9 bn). The negative overall trade balance with non-EU countries was cushioned by trade surplus with European transition economies and EFTA states amounting to CZK 8.7 bn and CZK 5.7 bn, respectively.

The trade balance with individual groups of countries and its year-on-year changes reflected the development of external trade balance with the main partner countries. Active balance with Germany, which, however, increased year on year just negligibly, and with other three countries (Slovakia, the United Kingdom, and France) was at total value of CZK 301.0 bn compared to CZK 265.3 bn in Q1 and Q3 2009. The largest portion of the total trade deficit with non-EU countries was produced in trade with China (due to high imports of computer technology, telecommunication equipment, and electrical equipment), followed by the Russian Federation, Japan, and Korea. The negative trade balance with these countries reached in total CZK 286.5 bn compared to CZK 227.6 bn in Q1 to Q3 2009. Trade deficit markedly deteriorated in trade with China (by CZK 50.8 bn), while external trade with Japan finished in a lower year-on-year negative trade balance (due to effects of decreased imports) in Q1 to Q3 2010.

Concerning commodity structure of external trade exports and imports in an overwhelming majority of SITC sections were growing in Q1 to Q3 of 2010. In comparison with Q1 to Q3 of 2009 they recorded in:

- machinery and transport equipment increased exports and imports by 16.8% (CZK 141.5 bn) and 24.2% (CZK 143.4 bn), respectively. These export and import increases were the largest among all SITC sections and therefore had a significant impact on the general growth in external trade. Trade surplus in ‘machinery and transport equipment’ in Q1 to Q3 of 2010 reached CZK 246.2 bn compared to CZK 248.1 bn in Q1 to Q3 of 2009 (CZK 393.6 bn with EU countries compared to CZK 341.3 bn in Q1 to Q3 of 2009). All groups of machinery recorded positive trade balance except for ‘electrical machinery, apparatus and appliances, n.e.s.’ (deficit CZK 13.0 bn) and ‘office machines and automatic data-processing machines’ (deficit CZK 1.4 bn). The highest positive trade balance was produced in trade in ‘road vehicles’, followed by ‘general industrial machinery and equipment’, ‘machinery specialized for particular industries’, ‘telecommunications and sound-recording equipment’, ‘other transport equipment’, ‘metalworking machinery’, and ‘power-generating machinery and equipment’. On year-on-year basis, the trade surplus increased in ‘road vehicles’ (by CZK 35.4 bn), ‘general industrial machinery and equipment’ (by CZK 12.0 bn), and in ‘machinery specialized for particular industries’ (by CZK 6.4 bn);

- manufactured goods classified chiefly by material increased exports and imports by 16.3% (CZK 46.2 bn) and 20.6% (CZK 54.1 bn), respectively. Positive trade surplus in the mentioned goods decreased (due to higher imports) to CZK 12.6 bn from CZK 20.5 bn in Q1 to Q3 of 2009. Deterioration of trade balance was caused mainly by a larger deficit of trade in ‘non-ferrous metals’ (by CZK 8.3 bn) and in ‘iron and steel’ (by CZK 6.4 bn). A large surplus (higher by CZK 2.5 bn, y-o-y) was recorded in ‘manufactures of metals’ and a higher surplus was recorded in ‘rubber manufactures’ (by CZK 4.8 bn), in the year-on-year comparison;

- miscellaneous manufactured articles, commodities and transactions not classified elsewhere in the SITC growing exports by 9.8% (CZK 18.3 bn) and imports by 1.6% (CZK 2.8 bn). Thus trade surplus increased by CZK 15.5 bn compared to Q1 to Q3 of 2009. The year-on-year increase of trade surplus was recorded in ‘miscellaneous manufactured articles, n.e.s.’ by CZK 9.0 bn and ‘furniture and parts thereof’ by CZK 5.3 bn (due to higher exports by 4.3 bn). Trade deficit improved in ‘articles of apparel and clothing accessories’ (by CZK 0.7 bn) and in ‘footwear’ (by CZK 1.0 bn); trade deficit, on the contrary, deteriorated in trade in ‘professional, scientific and controlling instruments and apparatus’ by CZK 1.8 bn);

- chemicals and related products increased exports and imports by 20.8% (CZK 21.1 bn) and 13.0% (CZK 21.9 bn), respectively. The trade deficit was the second highest among all SITC sections (CZK 67.7 bn compared to CZK 66.9 bn in Q1 to Q3 of 2009). A large trade deficit still pertained in ‘medicinal and pharmaceutical products’, although it decreased by CZK 3.4 bn, y-o-y, thanks to higher exports by CZK 2.9 bn and lower imports by CZK 0.5 bn. Trade deficit grew in ‘plastics in primary forms’ (by CZK 3.5 bn) and in ‘plastics in non-primary forms’ (by CZK 1.8 bn); trade deficit decreased in ‘chemical materials and products, n.e.s.’ by CZK 0.2 bn. Trade surplus increased in ‘organic chemicals’ by CZK 2.9 bn (mostly due to the impact of exports higher by CZK 5.3 bn, y-o-y);

- crude materials, inedible, and mineral fuels increased exports and imports by 25.2 % (CZK 24.9 bn) and 28.4% (CZK 47.5 bn), respectively. The deficit in trade in them increased by CZK 22.6 bn, y-o-y, and remained the highest among all SITC sections (CZK 91.4 bn). The trade deficit in ‘mineral fuels’ increased by CZK 24.5 bn, y-o-y, because trade surplus in ‘crude materials, inedible’ rose by CZK 1.9 bn, y-o-y. Due to higher imports by 21.0%, trade deficit deteriorated in ‘gas, natural and manufactured’ by CZK 7.5 bn (natural gas imports only rose, year on year, by 35.7% in volume and by 20.7% in value). Trade deficit grew by CZK 12.7 bn in ‘petroleum, petroleum products and related materials’ as imports of this commodity increased by 28.5%, y-o-y (petroleum imports only rose by 3.2% in volume, but in value it increased by 44.7%). The balance of trade in ‘crude materials, inedible, and mineral fuels’ was positively influenced by the increase in trade surplus in ‘coal, coke and briquettes’ (by CZK 1.6 bn), ‘metalliferous ores and metal scrap’ (by CZK 3.7 bn), ‘cork and wood’ (by CZK 1.3 bn), and in ‘pulp and waste paper’ (by CZK 1.2 bn). Trade surplus in ’electric current’ fell by CZK 5.9 bn, y-o-y;

- agricultural and food crude materials and products increased exports and also imports by 5.7% (CZK 3.9 bn) and 3.6% (CZK 3.3 bn), respectively. Trade deficit in these products improved on the year-on-year basis by CZK 0.6 bn. A larger trade deficit was noticed in ‘vegetables and fruit’ by CZK 1.3 bn and in ‘meat and meat preparations’ by CZK 0.2 bn, y-o-y. A marked drop (by CZK 2.0 bn) was recorded in trade surplus in ‘cereals and cereal preparations’; trade surplus in ‘tobacco and tobacco manufactures’ rose by CZK 0.7 bn and that in ‘live animals other than animals of division 03’ increased by CZK 0.4 bn.

| Divisions of SITC, rev. 4 | Divisions of SITC, rev. 4 | ||

| 0+1+4 | Agricultural and food crude materials and products | 6 | Manufactured goods classified chiefly by material |

| 2+3 | Crude materials, inedible, and mineral fuels | 7 | Machinery and transport equipment |

| 5 | Chemicals and related products | 8+9 | Miscellaneous manufactured articles, commodities and transactions not classified elsewhere in the SITC |

o- o - o

The data on external trade of EU countries, which was released by Eurostat on 15 October 2010, is available for the period of January-July 2010. In January-July 2010, exports of EU27 increased by 16.3% and imports by 16.4%, on average, y-o-y, respectively. Exports of EU15 and 12 new Member States were higher by 15.6% and 21.5%, respectively and their imports grew by 16.0% and 19.3%, on average, y-o-y, respectively. As compared to the same period of 2009, a year-on-year decline of exports was recorded solely for Luxembourg, imports dropped to Ireland, Greece, Luxembourg, and Malta. The increase in the year-on-year growth in exports and imports relatively substantially differed among respective states of EU27. The Czech Republic recorded the year-on-year growth in both exports and imports and ranked above the level of the year-on-year increase of exports and imports of EU27 states as well as EU15 states. Compared with new EU Member States, in the Czech Republic the year-on-year increase was slightly lower for exports (20.7%) and slightly higher for imports (22.3%). In January-July 2010, the share of the 12 new Member States in overall EU27 exports rose to 11.3% from 10.8% in January-July 2009; and their share in total EU27 imports rose to 11.7% from 11.4% in the same period of 2009. In January-July 2010 the EU27 trade balance deficit deteriorated to EUR 27.9 bn, compared to EUR 22.0 bn in January-July 2009, the EU15 trade deficit deteriorated to EUR 14.9 bn from EUR 7.4 bn, and that of 12 new EU Member States mitigated to EUR 13.0 bn from EUR 14.6 bn in the same periods. The Czech Republic recorded a trade surplus in January-July 2010. Among the new EU Member States, also trade balance of Hungary was positive (EUR 3.1 bn). Slovakia and Slovenia had their trade balances levelled.

1 All data are at current prices. Data for 2009 are final as at 27 August 2010 and data for January-September 2010 are preliminary as at 29 October 2010. Published data are processed in basic units and then rounded, which may give rise to discrepancies.

2 The European Free Trade Association

3 The Commonwealth of Independent States

4 China, North Korea, Cuba, Laos, Mongolia, and Vietnam

5 According to CPA classification (Section C - Division 10 - 33).

6 Export and import price indices in the Czech Republic are published later than data on the external trade of the CR.

7 See data in the attached table.

Contact: Information Services Unit - Headquarters, tel.: +420 274 056 789, email: infoservis@czso.cz