External trade - 2 quarter

09.08.2010

Code: q-6032-10

External trade 1 turnover in the first half of 2010 (after a year-on-year decrease by more than a fifth in the first half of 2009) reported a growth again . Increased exports and imports as compared to the first half of 2009 resulted in a higher external trade turnover by 15.4% (CZK 310.6 billion), y-o-y. However, it did not reach the level of the first half of 2007 (it was by 2% less). In the first half of 2010 external trade balance reached the highest half-year surplus (CZK 83.2 billion) since the first half of 2005, when the external trade of the Czech Republic for the first time from establishment of the independent Czech Republic recorded an active balance, which was characteristic for all the following years. In real terms, the trade balance surplus reached (according to estimates) CZK 101 billion and in the year-on-year comparison it increased approximately by CZK 21billion.

In the first half of 2010 compared to the first half of 2009:

- exports increased by 15.0% (CZK 157.0 bn) and reached CZK 1 206.7 bn, imports increased by 15.8% (CZK 153.6 bn) and made up CZK 1 123.4 bn. Exports and imports grew more strongly in Q2 (19.0% and 22.5% respectively) as compared to Q1 (10.9% and 9.2% respectively). A typical feature of Q2 was also a faster growth of imports compared to exports by 3.5 p.p. The year-on-year higher turnover of external trade by CZK 310.6 bn came from the growth of exports (50.5%) and imports (49.5%). In real terms, exports and imports increased by more than 19% and less than 19% respectively, y-o-y. Due to appreciation of CZK against EUR and against USD 2 , exports and imports in EUR and USD recorded more marked year-on-year growth in comparison with CZK. Exports and imports in EUR increased by 21.2% and 22.2% respectively, exports and imports in USD increased by 20.4% and 21.3% respectively;

- external trade surplus increased by CZK 3.4 bn and reached CZK 83.2 bn. The rate of coverage of imports by exports was 107.4% in comparison to 108.2% in the first half of 2009. By group of countries, improvement of trade balance is only contributed to by the year-on-year higher trade surplus with EU countries by CZK 47.0 bn, because trade deficit with non-EU countries deteriorated by CZK 43.6 bn, y-o-y. Trade surplus decreased with EFTA 3 states by CZK 0.6 bn and with the European transition economies it remained practically the same as in the first half of 2009. Trade deficit improved with other developed market economies (by CZK 5.7 bn). Trade deficit deteriorated with developing economies by CZK 11.8 bn, with the CIS 4 countries by CZK 15.9 bn, and with other states 5 by CZK 20.9 bn. By commodity section, trade surplus grew in 'machinery and transport equipment' (by CZK 11.8 bn) and in 'miscellaneous manufactured articles' (by CZK 10.4 bn) and fell in 'manufactured goods classified chiefly by material' (by CZK 7.7 bn). Insignificant decrease of trade deficit by CZK 0.4 bn was recorded in 'chemicals and related products'. Trade deficit increased in' agricultural and food crude materials and products' (by CZK 0.8 bn) and especially in 'crude materials, inedible, and mineral fuels' (by CZK 10.4 bn);

- by group of countries, the share of EU countries in total exports dropped (from 85.0% to 84.4%), EFTA states (from 2.2% to 2.1%) and European transition economies (from 0.8% to 0.7%). The share increase was obvious in other developed market economies (from 3.7% to 4.0%), developing economies (from 4.1% to 4.2%), CIS countries (from 3.4% to 3.6%) and other states (from 0.7% to 1.0%). In total imports, the shares decreased of EU countries (from 66.4% to 64.4%) and other developed market economies (from 7.2% to 6.5%). The shares of EFTA states and European transition economies remained the same as in the first half of 2009 (2.0% and 0.3% respectively). The shares grew of other states (from 10.0% to 10.9%), CIS countries (from 6.7% to 7.8%) and developing economies (from 6.9% to 7.7%);

- by commodity section, in total exports, shares grew of 'machinery and transport equipment' (from 53.3% to 53.9%), 'crude materials, inedible, and mineral fuels' (from 6.0% to 6.8%) and 'chemicals and related products' (from 6.2% to 6.6%). Shares decreased of 'manufactured goods classified chiefly by material' (from 18.1% to 17.8%), 'miscellaneous manufactured articles' (from 11.8% to 11.0%) and 'agricultural and food crude materials and products' (from 4.5% to 4.0%). In total imports shares increased of 'machinery and transport equipment' (from 40.8% to 42.2%), 'manufactured goods classified chiefly by material' (from 17.9% to 18.3%) and 'crude materials, inedible, and mineral fuels' (from 11.3% to 12.3%). Shares dropped in 'chemicals and related products' (from 11.3% to 11.1%), 'agricultural and food crude materials and products' (from 6.4% to 5.7%) and 'miscellaneous manufactured articles' (from 12.2% to 10.4%).

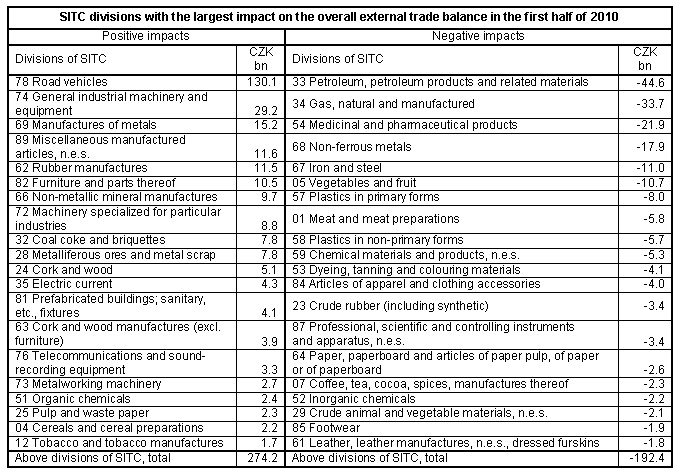

The main impacts on external trade in the first half of 2010 were:

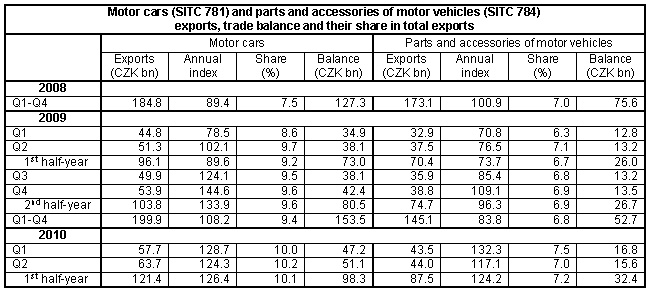

- increasing industrial production in manufacturing industries 6 which were most strongly afflicted by recession. The growth in manufacturing industries (thanks to external demand) had a positive impact on manufacturing exports, which increased by 15.5% (CZK 151.1 bn) and their share in total exports increased to 93.5% from 93.1% in the first half of 2009. The most important shares in manufacturing exports had 'machinery and transport equipment' (especially 'road vehicles'), 'electrical machinery, apparatus and appliances', 'office machines and automatic data-processing machines', 'general industrial machinery and equipment' and 'telecommunications equipment n.e.s. '. Exports of 'road vehicles' made up 18.2% of total exports in the first half of 2010 (17.0% in the first half of 2009). Trade surplus in road vehicles produced the highest surplus among all SITC classes (CZK 130.1 bn) and was up by CZK 30.8 bn compared with the first half of 2009. Surplus in 'motor cars' increased by CZK 25.3 bn and surplus in 'parts and accessories of motor vehicles' rose by CZK 6.4 bn, year-on-year.

The second largest trade surplus in machinery and transport equipment (and also in total external trade) was recorded for 'general industrial machinery and equipment' (CZK 29.2 bn compared to CZK 21.4 bn in the first half of 2009);

- unfavourable terms of trade 7 . Preliminary data show that in January-June 2010, as against January-June 2009, export and import prices went down by more than 3% and by 1% respectively on average. Terms of trade reached negative values and, therefore, had a negative impact on external trade balance at current prices. According to estimates for January-June 2010, export and import prices decreased exports and imports by approx. CZK 45 bn and CZK 27 bn respectively. Negative impact of prices on trade surplus at current prices for January-June 2010 accounted for about CZK 18 bn;

- slight revival of the world economy and with it connected increase of external demand. The economic growth was restored mainly in the United States, in Asian economies (particularly China and Japan), but also in the Russian Federation, while the economic growth in the European Union has been still insignificant. However, positive for Czech exports is a revival of the economy of Germany, especially in Q2 2010. This biggest European economy is the most important export destination for Czech companies and largely predetermines the total development of Czech exports (31.5% of total exports were oriented to the German market in the first half of 2010). Compared with the first half of 2009, exports to Germany increased by 10.1%.

- persisting weaker internal (especially consumer) demand, which caused the y-o-y reduction in imports of 'miscellaneous manufactured articles' (by 1.7%), but also of some food products and crude materials. Imports decreased in clothing, footwear and furniture. Investment demand slightly revived, which caused an increase in imports of some machinery items (e.g. 'office machines and automatic data-processing machines', 'electrical machinery, apparatus and appliances, n.e.s. ' and 'power-generating machinery and equipment' and 'motor vehicles for transport of goods'), crude materials, materials and products classified chiefly by material.

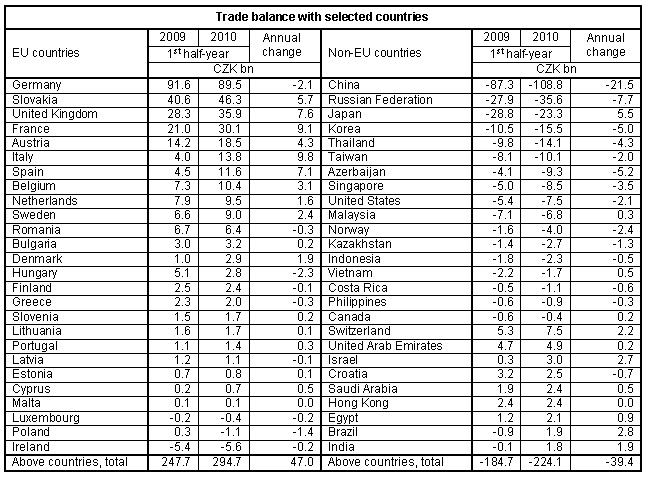

A closer look at external trade by group of countries in the first half of 2010 8 shows that, in comparison with the first half of 2009:

- exports to EU countries increased by 14.1% (CZK 126.1 bn) and to non-EU countries by 19.6% (CZK 30.9 bn). The largest relative annual growth was observed in exports to other states followed by other developed market economies, CIS countries, developing economies and EFTA states; exports decreased only to European transition economies. Higher exports to EU countries in total reflected higher exports to all EU countries except for Latvia and Greece. The biggest absolute increase was observed in exports to Germany (CZK 34.8 bn), followed by exports to Poland (CZK 12.2 bn), Italy (CZK 11.9 bn), Slovakia (CZK 11.2 bn), the United Kingdom (CZK 9.4 bn, France (CZK 9.1 bn), Spain (CZK 8.8 bn), Austria (CZK 7.3 bn) and the Netherlands (CZK 6.0 bn). Among non-EU countries, exports increased to the Russian Federation (CZK 4.0 bn), China (CZK 3.6 bn), the United States (CZK 3.2 bn), Switzerland (CZK 2.2 bn), Ukraine (CZK 1.6 bn) and Japan (CZK 1.3 bn);

- imports rose from EU countries by 12.3% (CZK 79.1 bn) and from non-EU countries by 22,9 % (CZK 74.5 bn). The most marked relative increases were recorded for imports from CIS countries, followed by imports from developing economies, other states, EFTA states and other developed market economies; imports from European transition economies decreased. Higher imports from EU countries in total resulted from increasing imports from all EU countries except from Latvia and Malta. The biggest absolute increases were recorded for imports from Germany (CZK 36.9 bn), followed by imports from Poland (CZK 13.7 bn), Slovakia (CZK 5.5 bn), the Netherlands (CZK 4.4 bn), Hungary (CZK 3.5 bn), Austria (CZK 3.0 bn), Italy (CZK 2.1 bn), the United Kingdom (CZK 1.8 bn), Spain (CZK 1.7 bn) and Romania (CZK 1.4 bn). Among the non-EU countries, mainly imports from China (CZK 25.1 bn), the Russian Federation (CZK 11.7 bn), Azerbaijan (CZK 5.6 bn), the United States (CZK 5.3 bn), Korea (CZK 4.9 bn), Thailand (CZK 4.5 bn), Ukraine (CZK 3.5 bn), Norway (CZK 3.0 bn) and Taiwan (CZK 2.4 bn) grew. Drop was recorded for imports from Japan (CZK 4.2 bn) and Canada (CZK 0.3 bn);

- external trade surplus was slightly higher. Trade surplus with EU countries reached CZK 294.7 bn against CZK 247.7 bn in the first half of 2009, and trade deficit with non-EU countries was CZK 211.5 bn compared to CZK 167.9 bn in the first half of 2009. The highest trade deficit was still recorded with other states (CZK 110.3 bn), CIS countries (CZK 44.9 bn), developing economies (CZK 36.3 bn) and other developed market economies (CZK 24.8 bn). The total trade gap with non-EU countries was cushioned by trade surplus with European transition economies and EFTA states amounting to CZK 5.6 bn and CZK 2.9 bn respectively.

The trade balance and balance increases/decreases (annual changes) with individual groups of countries reflected the situation of external trade balance with the main partner countries. A large effect (CZK 201.8 bn compared to CZK 181.5 bn in the first half of 2009) on the total trade surplus with EU countries was active balance with Germany (which, however, deteriorated in the year-on-year comparison) and with other three countries (Slovakia, the United Kingdom and France). The biggest portion of the total trade deficit with non-EU countries was produced in trade with China, followed by the Russian Federation, Japan and Korea. The total trade deficit with these countries reached CZK 183.2 bn compared to CZK 154.5 bn in the first half of 2009. Trade deficit markedly deteriorated in trade with China, while external trade with Japan recorded an improvement of trade deficit (due to drop in imports), compared with the first half of 2009.

Increasing exports and imports in an overwhelming majority of SITC sections were a feature of commodity structure of external trade in the first half of 2010. In comparison with the first half of 2009, movements in the commodity structure were characterised in:

- machinery and transport equipment by increasing exports and imports by 16.2% (CZK 90.8 bn) and by 20.0% (CZK 79.0 bn) respectively. These export and import increases were the largest among all SITC sections and had a significant impact on the general growth in external trade. Trade surplus in machinery and transport equipment reached CZK 175.8 bn compared to CZK 163.9 bn in the first half of 2009 (CZK 267.9 bn with EU countries compared to CZK 230.7 bn in the first half of 2009). All groups of machinery recorded active balance except for electrical machinery, apparatus and appliances, n.e.s. (deficit CZK 0.7 bn). The highest surplus was produced in trade in road vehicles, followed by general industrial machinery and equipment, machinery specialized for particular industries, telecommunications and sound-recording equipment, metalworking machinery, office machines and automatic data-processing machines. Compared with the first half of 2009, the trade surplus increased in road vehicles (by CZK 30.8 bn), general industrial machinery and equipment (by CZK 7.8 bn) and machinery specialized for particular industries (by CZK 3.4 bn);

- manufactured goods classified chiefly by material by increasing exports and imports by 13.0% (CZK 24.6 bn) and by 18.6% (CZK 32.3 bn) respectively. Trade surplus in mentioned goods decreased (due to higher imports) to CZK 8.5 bn from CZK 16.2 bn in the first half of 2009. Deterioration of trade balance was caused mainly by a larger trade deficit in non-ferrous metals (by CZK 5.3 bn) and iron and steel (by CZK 4.7 bn). A large surplus (the same as in the first half of 2009) was maintained in manufactures of metals and a higher surplus was recorded in rubber manufactures (by CZK 3.5 bn), in the year-on-year comparison;

- miscellaneous manufactured articles, commodities and transactions not classified elsewhere in the SITC by growing exports by 7.0% (CZK 8.7 bn) and decreasing imports by 1.4% (CZK 1.7 bn). Trade surplus increased by CZK 10.4 bn compared to the first half of 2009. The year-on-year increase of trade surplus was recorded in miscellaneous manufactured articles, n.e.s. by CZK 4.9 bn and furniture and parts thereof by CZK 4.2 bn (due to lower imports). The trade deficit improved in articles of apparel and clothing accessories (by CZK 0.4 bn) and in footwear (by CZK 0.9 bn); the trade deficit deteriorated in professional, scientific and controlling instruments and apparatus (by CZK 0.9 bn);

- chemicals and related products by increases in exports and imports by 23.0% (CZK 15.0 bn) and by 13.3% (CZK 14.6 bn) respectively. The trade deficit was the second highest among all SITC sections (CZK 44.4 bn compared to CZK 44.8 bn in the first half of 2009). A large trade deficit was still in medicinal and pharmaceutical products, although it decreased by CZK 1.5 bn, y-o-y, thanks to higher exports. Trade deficit grew in plastics in primary forms (by CZK 2.9 bn) and plastics in non-primary forms (by CZK 1.0 bn); trade deficit decreased in chemical materials and products, n.e.s. by CZK 1.1 bn. Trade surplus increased in organic chemicals by CZK 2.2 bn (due to higher exports by almost two fifths compared to the first half of 2009);

- crude materials, inedible, and mineral fuels by increasing exports and imports by 28.0 % (CZK 17.8 bn) and by 26.1% (CZK 28.5 bn) respectively. The trade deficit increased by CZK 10.7 bn, y-o-y, and remained the highest among all SITC sections (CZK 56.4 bn). The trade deficit in mineral fuels increased by CZK 14.1 bn, y-o-y, since trade surplus in crude materials rose by CZK 3.4 bn, y-o-y. Due to higher imports by 15.5%, trade deficit deteriorated in gas, natural and manufactured by CZK 3.1 bn (natural gas imports rose by more than 56% in volume and by 15.2% in value). Trade deficit grew by CZK 8.6 bn in petroleum, petroleum products and related materials as imports of this commodity increased by 31.9% y-o-y (petroleum imports fell almost by 2% in volume, but rose almost by a half in value). The balance of trade in crude materials, inedible, and mineral fuels was positively influenced by increase in trade surplus in coal, coke and briquettes (by CZK 1.8 bn), metalliferous ores and metal scrap (by CZK 4.7 bn), cork and wood (by CZK 0.4 bn) and pulp and waste paper (by CZK 0.8 bn). Trade surplus in electric current fell by CZK 4.2 bn, y-o-y;

- agricultural and food crude materials and products by slightly increasing exports by 0.3% (CZK 0.2 bn) and imports by 1.4% (CZK 0.9 bn). Trade deficit grew by CZK 0.7 bn, y-o-y. A larger trade deficit was in vegetables and fruit (by CZK 0.5 bn) and meat and meat preparations (by CZK 0.1 bn). A marked drop (by CZK 2.3 bn) was recorded in trade surplus in cereals and cereal preparations; trade surplus in tobacco and tobacco manufactures rose by CZK 0.5 bn.

| Sections of SITC, rev. 4 | Sections of SITC, rev. 4 | ||

| 0+1+4 | Agricultural and food crude materials and products | 6 | Manufactured goods classified chiefly by material |

| 2+3 | Crude materials, inedible, and mineral fuels | 7 | Machinery and transport equipment |

| 5 | Chemicals and related products | 8+9 | Miscellaneous manufactured articles, commodities and transactions not classified elsewhere in the SITC |

o - o - o

For the time being, data on external trade of EU countries are available only for January-April 2010. Eurostat released the data on 16 July 2010. In January-April 2010, exports of EU27 in EUR increased by 12.6% and imports of EU27 by 10.9% on average, y-o-y. Exports of EU15 and 12 new member states were higher by 11.9% and 18.6% and imports from these states grew by 10.4% and 15.1% on average, y-o-y. As compared with the same period of 2009, the year-on-year decline of exports only in 2 member states (Ireland and Luxembourg) and of imports in four member states (Denmark, Ireland, Greece and Luxembourg) was recorded. The Czech Republic recorded the year-on-year growth in exports and imports and ranked above the level of the year-on-year increase of exports and imports of EU states in total as well as EU15 states. Compared with new EU member states, the year-on-year increase was slightly lower for exports and slightly higher for imports in the Czech Republic. In January-April 2010, the share of the 12 new member states in total EU exports rose to 11.2% from 10.7% in January-April 2009 and their share in total EU imports rose to 11.6% from 11.2% in the same period of 2009. In January-April 2010 the EU27 trade balance reached a deficit of EUR 16.6 bn, compared to EUR 31.3 bn in January-April 2009, the EU15 trade deficit was EUR 10.6 bn and EUR 22.7 bn and the 12 new member states' deficit was EUR 6.0 bn and EUR 8.6 bn in the same periods. The Czech Republic (similarly as the seven other EU states) recorded a trade surplus in January-April 2010 (EUR 2.4 bn). Among the new EU member states, the trade balance of Hungary and Slovakia also resulted in a surplus (EUR 1.8 bn and EUR 0.2 bn respectively) in the mentioned period.

1 All data are at current prices. Data for 2009 and 2010 are preliminary. Published data are processed in basic units and then rounded, which may give rise to discrepancies.

2 In January-June 2010, compared with January-June 2009, CZK strengthened by 5.5% and 5.0% on average against EUR and USD respectively.

3 The European Free Trade Association

4 The Commonwealth of Independent States

5 China, North Korea, Cuba, Laos, Mongolia and Vietnam

6 According to CPA classification (Section C - Division 10 - 33).

7 Export and import price indices in the Czech Republic are published later than data on the external trade of the CR.

8 See the data in the attached table.

Contact: Information Services Unit - Headquarters, tel.: +420 274 056 789, email: infoservis@czso.cz