Statistical definitions of The Satellite Account of Public Sector

I. Basic definition (Coverage – sector, area)

Satellite accounts allow focusing attention on a particular area or aspect of economic and social life in the context of national accounts. Satellite accounts are one way in which the national accounts system can be adapted to meet differing circumstances and needs.

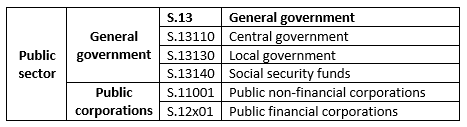

The Satellite Account of Public Sector (SUVS) provides a comprehensive view of the public sector economy. The SUVS covers all units controlled by the government. In addition to the units included in the general government sector, whose data are used to calculate the Maastricht convergence criteria, the public sector also includes government-controlled non-financial corporations that operate on a market basis and public financial corporations, including the central bank.

The analytical contribution of the satellite account lies in the full representation of the direct impact of government on the economy as well as the economic relations between the private and public sectors.

The main objective of the production of the SUVS is to calculate the balance (surplus/deficit) and debt for the public sector.

The compilation of SUVS is based on the methodology of the ESA 2010 System of National Accounts and the Public Sector Debt Statistics.

II. Data source

1. Statistical surveys

NI 1-01 Annual survey of non-profit institutions,housing cooperatives and selected institutions

P 5-01 Annual statistical survey in business units

Pen 5-01 Annual statement of financial (monetary) institutions

Poj 5a-01 Annual statistical survey of Insurance and Reinsurance Companies

VI 1-01 Annual questionnaire for selected government institutions

Zdp 5-01 Annual statistical survey of health insurance companies

2. Administrative data sources, collected data

CNB Administrative data source of the Czech National Bank

IISSP Administrative data source of Integrated Information System of the State Treasury

FIN 2-12 data from budgetary classification

PAP Auxiliary Analytical Overview

MFČR Administrative data source of the Ministry of Finance

DAPFO/DAPPO Income tax returns of individuals / legal entities

Data for the general government sector and the public non-financial corporations subsector can be obtained directly from published sectoral accounts; in the case of financial institutions, it is necessary to quantify the deficit and debt beyond the standard published sector accounts.

The input data for the SUVS for public non-financial and public financial institutions correspond to the data published in the annual national accounts. General government sector is represented by data from the general government deficit and debt notifications. The subsequent consolidation of flows within the public sector affects particularly subsidies and investment grants, as well as paid dividends and interest. Consolidation does not affect the opening balance of the public sector as a whole, but changes the contributions of individual economic sectors to the balance.

In addition to the inclusion of a wider number of entities (public financial and non-financial corporations) compared to EDP (Excessive Deficit Procedure) statistics, there is also, in the case of debt, a difference in the method of valuing debt instruments.. For the purposes of the Maastricht criteria, debt is reported at nominal value (excluding accrued interest), including hedging currency derivatives. In the national accounts and the SUVS, debt is valued at market prices and without the influence of hedging currency derivatives.

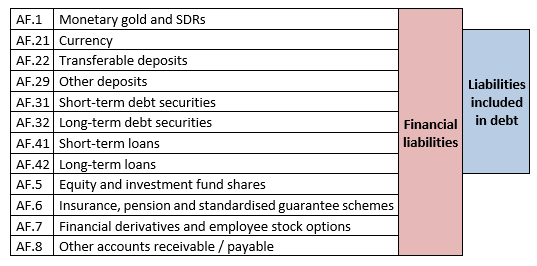

Public sector debt includes the following liability items:

Currency and deposits (AF.2),

Debt securities (AF.3)

Loans (AF.4).

Public sector debt is reported on a consolidated basis, i.e. after excluding inter-entity relationships within the public sector. If the debt of a public institution is also an asset of another public institution, this debt does not affect the total amount of public sector debt externally.

III. Delineation of statistical population and sample, grossing up and estimation of the non-treated part of the population (if relevant)

The survey P 5-01 includes results from annual statistical survey in business units. It is the main source of statistical data for the sectors S.11, S.125, S.126, S.127 and the auxiliary data source for the sectors S.1311 and S.1313. It is a combination of exhaustive and sample survey. The survey is exhaustive for units with 100 and over employees, units with turnover over 250 million CZK and units selected by other criteria according to the amount of property, the amount of assets and industry. Reporting units are legal entities with the principal activity according to the classification of economic activities CZ-NACE, non-bank financial institution (leasing companies, others financial intermediaries, others financial auxiliaries). Method used to impute for missing data is the regression model based on one-dimensional or two-dimensional linear regression. Data from available administrative sources are used for calculation difference for grossing-up to the population.

The statistical questionnaire VI1-01 is intended for government institutions. It is used as an additional data source for compiling national accounts for units belonging to sectors S.1311 and S.1313. Reporting units are municipalities and semi-budgetary institutions that do not submit an Auxiliary Analytical Overview (PAP); voluntary associations of municipalities; the Support and Guarantee Agriculture and Forestry Fund, the Railway Infrastructure Administration, PRISKO a.s. It is a sample survey for municipalities and semi-budgetary institutions; exhaustive for other reporting units.

Reporting units of the annual survey of non-profit institutions, housing cooperatives and selected institutions NI 1-01(a) are among others also public universities, public research institutions, Czech Television and Czech Radio, and selected non-profit organisations in S.11, banking associations and funds.

Annual statement of financial (monetary) institutions Pen 5-01 is the main source of data for financial institutions that maintain books of account as banks. It is used for compilation of full sequence of national accounts of units in sectors S.124, S.125 and S.126.

For more details, please see ESA 2010 GNI Inventory 2018.

IV. Overview of main published indicators

Revenue, expenditure, deficit and debt of the public sector on an annual basis.

V. Data revision policy - corrections, revisions, refinement procedure of estimations

The statistics are always published in T+23 months and include both regular and extraordinary revisions, following the dates of regular and extraordinary revisions of the national accounts.

VI. Comparability

1. Comparability over time

Full at the time of government and national accounts revisions.

2. Comparability with other outputs

With national accounts at the time of the accounts revisions.

3. International comparability

Ensured by compilation according to ESA 2010 and the Public Sector Debt Statistics.

VII. Seasonal Adjustment (if relevant)

Not relevant

VIII. Dissemination (description of the publication system, references to Eurostat outputs or national outputs may be provided)

Database of the Satellite Account of Public Sector

https://apl.czso.cz/pll/rocenka/rocenka.indexnu_svs?mylang=EN

IX. Additional methodological information and external references

Web sites of the CZSO

Inventory of the methods, procedures and sources used for the compilation of deficit and debt data and the underlying government sector accounts according to ESA201

https://apl.czso.cz/pll/rocenka/b1.metodika?mylang=EN

Explanatory notes:

Consolidating a certain indicator for a group of units means that we exclude from the value of the indicator all relationships (transactions) within the group so that the group appears as one unit in relation to its surroundings (to units outside the group).

The deficit /surplus of public institutions is the result of the economic activity of public institutions, i.e. the difference between their revenue and expenditure, or net lending (+) /net borrowing (-) respectively. A positive value is a surplus, a negative balance is referred to as deficit. This is the economic balance in the European System of Accounts (ESA 2010).

The debt of public institutions represents accumulated indebtedness. The consolidated debt of public institutions shows the liabilities that all public institutions have towards entities that are not public institutions. The debt consists of the following items: